Since the year 2022 started, there has been consistent growth in the funding attracted by fintech startups from investors. In its State of Venture report on global funding inflows for Q2 2022, CB Insights states that startups recorded a total of $108.5 billion in funding in Q2 2022. But the story is only just beginning. Even though the funding raised is impressive, it is less than its 2021 counterpart for the same quarter.

When we compared it to the $141.6 billion that came in as funding globally in Q2 2021, Q2 2022 recorded a marked 23% decrease in funding inflows. This is the largest quarterly percentage drop in almost 10 years, according to data from CB Insights.

The drop in funding is accompanied by a concurrent drop in the number of companies that attained unicorn status in Q2 ‘22. Only 85 companies became unicorns compared to the 148 companies that were recorded in Q2 last year. Considering that 148 companies became unicorns in Q2 ‘21 and there was much higher funding ($141.6 billion) recorded, there is a strong connection between the number of new companies which attain unicorn status and the volume of funding that leaves that investors put into startups.

African fintech startups are seeing sustained growth and increased Funding YoY

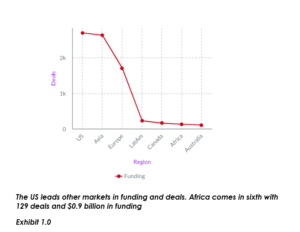

In deals and funding, fintech startups in Africa came in 6th with 129 deals and a total of $0.8 billion, according to data from CB Insight. The US is first with 2,698 deals and $52.9 billion in funding, and Asia is second with 2,630 deals and $27 billion.

sEurope is third with 1,705 deals and $22.7 in funding, Latin America and the Caribbean are 4th with 224 deals and $2.3 billion while Canada comes in 5th with 159 deals and $2 billion in funding. Africa outranks Australia, which comes in seventh place with 106 deals and $0.7 billion.

When we compared both quarters, there was an increase in funding and deals all around from Q2 2021 to Q2 2022. In Q2 ‘21, startups received $245 million through 127 deals. There was a slight increase in the number of deals from 127 to 129 QoQ, however, the increase in funding is much more significant as African startups attracted a total of $794 million ($0.8 Billion) in funding.

Out of the 129 deals in Q2 2022, 2 were mega-rounds and interestingly, both were secured by startups in Kenya. The two companies are Sun King, a solar provider and Wasoko, a B2B retail and e-commerce platform. Techcrunch reports that Sun King raised $260 million in its Series D round while Wasoko raised $125 million in series B funding.

Deals and funding inflows into Nigeria

Nigeria recorded funding of $198M in Q1 2021 while Q2 saw a rather sharp drop in funding. Just $35 million trooped into Africa’s top VC investment destination through a total of 39 deals, according to CB Insights. The country also witnessed a drop in the volume of funding per deal. In Q2 ‘21, just 23 deals were recorded and they amounted to $31 million while Q2 ‘22 pulled in 39 deals (a 70% increase in deals QoQ) but which only resulted in $35 million (13% in funding QoQ). Although the increase in funding is not as steep, it is significant.

Funding inflows into Africa have continued to grow quarter on quarter from 2021 to 2022 in contrast to other regions. According to Max Cuvellier of The Big Deal, Africa is the only region that has continued to grow YoY if we look at the yearly evolution of quarterly funding from Q2 2021 to Q2 2022.

Will funding slow down in Q3 2022?

The total amount of funding that startups receive every quarter depends on how many deals are successful between investors and startups. In addition to the number of deals, the amount invested in each deal also determines how large or small the funding for each quarter is.

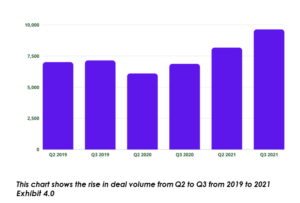

A total of 7,651 deals were recorded in Q2 ‘22 and this resulted in $108.5 billion in funding globally while 8,990 deals were recorded earlier in Q1. The figures from Q1 and Q2 show a decline in the volume of deals and funding. This trajectory automatically points to a further decline in deals and funding in Q3 but the trend over the last 3 years (2019 to 2021) shows an unusual uptake in deals and funding for Q3 of each year.

This is the story the numbers tell for each of those 3 years. In Q1 2021, 7,888 funding deals took place between startups and investors from all countries of the world and the deals amounted to $133.3 billion in funding. This number rose higher in Q2 ‘21 to 8,161 deals and led to $152.4 billion in recorded funding. In Q3 of the same year, the total number of deals increased to 9,622 deals with global funding of $162.5 billion.

This same pattern was observed in 2020 and 2019 although with an interesting twist in the figures for both years. 2020 started off with 6,325 deals in Q1 and a total of $60.2 billion in funding. Q2 was a bit different as investors made lesser deals with startups and at the end of the quarter, the numbers dropped to 6,089 deals and the funding also dropped to $60 billion in funding.

Q3 of 2020 shows investors spending more money and making more deals with a total of 6,860 deals and $84.6 billion in funding. The figures for Q3 ‘20 and Q3 ‘21 both show an increase in deals and funding. 2019 is not much different as startups pegged 7,162 deals with total funding of $69.1 billion in the first quarter. In Q2, both deals and funding dropped to 6,998 and $65.9 billion respectively in Q2 of the same year.

However, as witnessed in 2020 and 2021, the number of deals that were made between startups and investors increased in the third quarter. The number of deals rose from 6,998 in Q2 ‘19 to 7,133 in Q3 ‘19 which led to $65.5 billion in funding.

The funding and deal statistics from the last 3 years give some foresight into what Q3 might be holding for startups regarding deals and funding. From past trends, it can be expected that the number of deals will rise from the 7,651 that was recorded in Q2 and inch closer to the 8,000 mark. We also expect that global funding will be higher than the $108.5 billion recorded in Q2 but lower than the $141.6 billion recorded in Q1 2022.

What are your views about the funding activities for Q2 and how do you think it will fare in Q3? Share your opinion in the comments section and let’s discuss the fintech ecosystem.

Leave a Reply