Fintech Association of Nigeria (FintechNGR) is a self-regulatory, not-for-profit, and non-political organization incorporated in Nigeria by the Corporate Affairs Commission CAC and a member of the global body Global Fintech Hubs Federation. The association was established to serve as a platform for the development of the financial technology (“fintech”) industry in Nigeria and to be a forum for the exchange of ideas and dissemination of information by and between various stakeholders in the Nigerian financial technology services industry. Since inception. The association has consistently been interfacing with the regulators such as CBN, SEC, national insurance commission, and the government at all levels with a view to developing the fintech ecosystem.

To foster an ecosystem that supports all stakeholders to achieve a thriving and growing Nigerian fintech industry and to make Nigeria one of the world’s leading markets for fintech innovation and investment.

To make Nigeria one of the world’s leading markets for fintech innovation and investment.

Our team brings together a diverse group of professionals with deep expertise in finance, technology, policy, and industry advocacy. Guided by a Board of Trustees & a strong Governing Council, our leadership is structured to drive the strategic vision of FintechNGR, while our dedicated staff manage operations and execute projects that strengthen Nigeria’s fintech ecosystem. Members of our team are passionate advocates for innovation and are committed to positioning Nigeria as a leader in digital financial services.

FintechNGR brings together a diverse range of stakeholders, including startups, established financial institutions, technology companies, investors, regulators, and policy makers. This dynamic ecosystem is designed to encourage innovation and facilitate the growth of fintech in Nigeria.

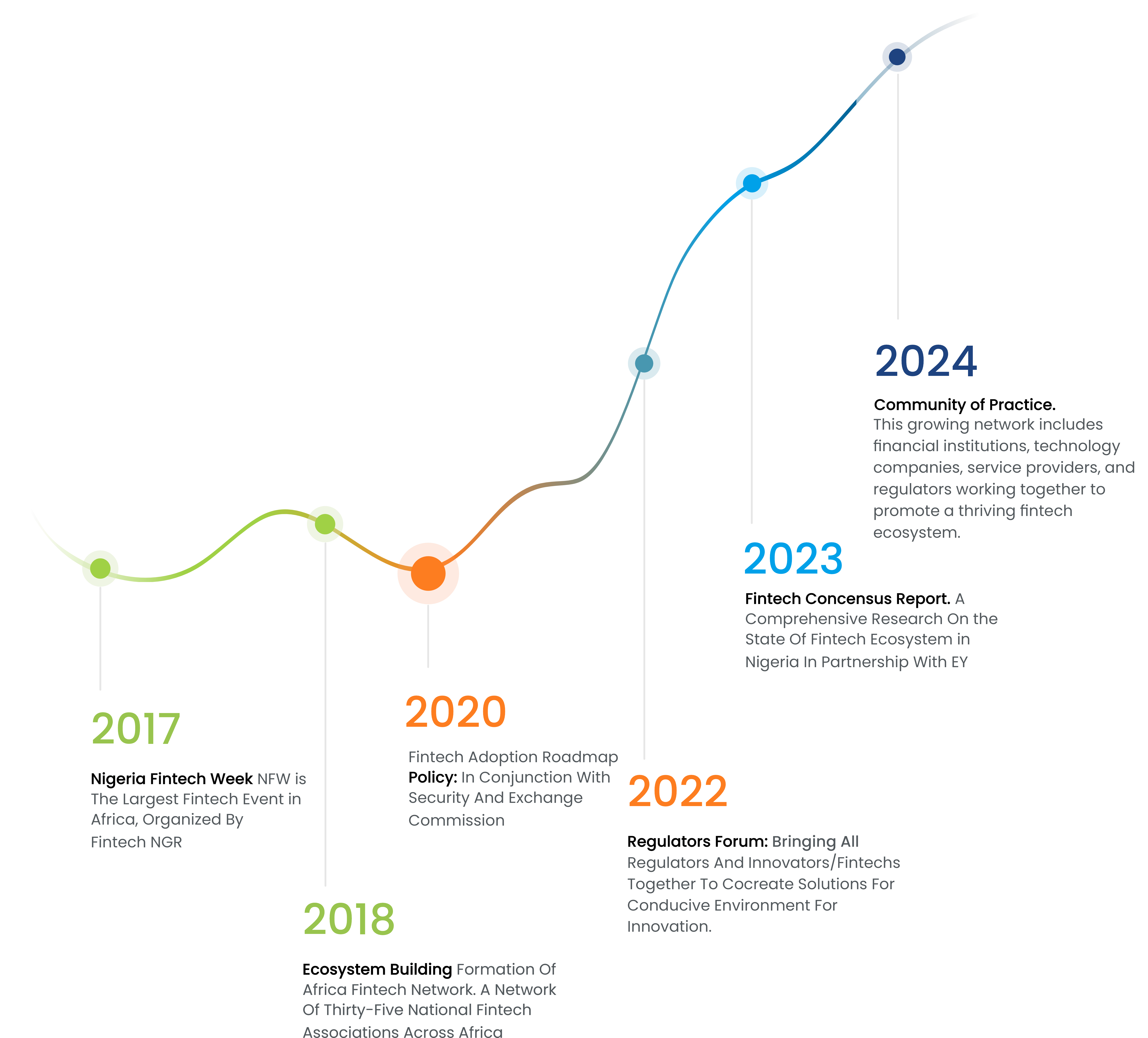

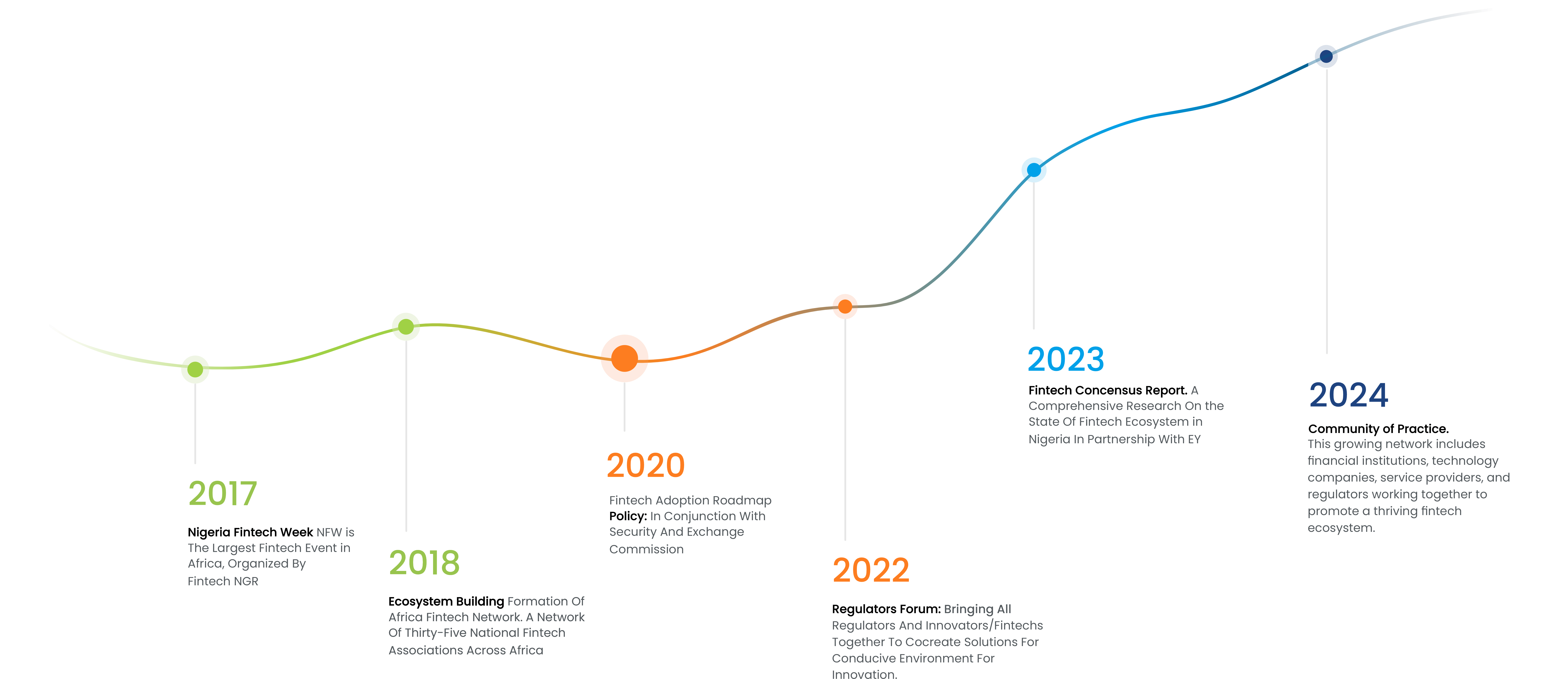

Pioneering and leading the advancement of Nigeria’s fintech industry for over 7 Years!

NFW is the largest fintech event in Africa, organized by FintechNGR

Bringing all regulators and innovators/ fintechs together to cocreate solutions for conducive environment for innovation. (2020 – date)

A comprehensive research on the state of Fintech ecosystem in Nigeria in partnership with EY (2020)

In conjunction with Security and Exchange Commission (2024)

Startup Marketplace, Advisory, Regulatory and Funding support.

Formation of Africa Fintech Network, a Network of thirty-five national Fintech Associations across Africa (2018 – date)

Hands-on Digital Skills Empowerment Project for Students & Lecturers of Public Tertiary Institutions (2021 – date)

This growing network includes financial institutions, technology companies, service providers, and regulators working together to promote a thriving fintech ecosystem.

Connects fintech leaders, founders, and policymakers to foster collaboration, innovation, and advocacy, while driving policy changes and creating networking for fintech CEOs

Our Membership Plans offer exclusive access to a thriving network of fintech professionals, industry insights, and cutting-edge resources. Whether you’re a startup, established company, or an individual innovator, our plans are designed to support growth, foster collaboration, and provide unparalleled opportunities for learning and development within the financial technology sector.

Join the movement: Register today and be a part of Nigeria’s fintech evolution.

Dr Segun Aina is a global professional banking leader, internationally rated change driver, influencer and thought leader, respected futurist and a consistent philanthropist. He had three decades of distinguished banking career and voluntarily retired from active banking service after a six years tenure as Bank MD/CEO.

Dr. Aina is the inaugural Chairman of Global Council of Global Banking Education Standards Board (GBEStB) 2017 to date, a past President of Chartered Institute of Bankers of Nigeria (CIBN 2012 to 2014), and past president of the West African Bankers Association (Nigeria Chapter) 2001.

A tech visionary who set up Fintech Associates Ltd as far back as 2002, he is founding President, Fintech Association of Nigeria (FTAN), initiator and founding President of the Africa Fintech Network (AFN), Founder/Chairman, The Fintech Institute (TFI) among others.

Dr. Aina who has been variously described as Nigeria’s finTech envoy, incubated a number of successful fintech startups and sits on the Boards of various institutions in Banking, Insurance, Agriculture, Technology sectors etc. He also serves as a member of the UK-Africa Fintech Investment Group, a UK Govt initiative co-Chaired by the Lord Mayor of London and UK Prime Minister Ambassador for Business Fintech.

Dr. Aina is a distinguished alumnus of University of Lagos, University of Ibadan, INSEAD France, Harvard Business School (HBS), IMD Switzerland, and the esteemed Lagos Business School (LBS).

His contributions to the academic sector is legendary – he was a member of the pioneer Advancement Board of Obafemi Awolowo University 2006 to 2012 and currently Chairman Advancement Board of Federal University of Technology Akure (2011 to date), Chairman National Think Tank (initiative of University of Ibadan Research Foundation of which he is a member) and Member, Osun State University Advancement Board.

Dr Aina is Fellow of London Institute of Banking and Finance, Chartered Institute of Bankers of Nigeria, Nigerian Institute of Chartered Arbitrators, Institute of Directors, Nigerian Institute of Management as well as Member, Toronto Region Board of Trade, Canada and Canadian Council for Africa.

He holds the Nigeria National honors of Officer of the Order of Federal Republic (OFR) and has received honorary doctorate degrees from three Universities.

Funke Opeke, is Managing Director of MainOne, a leading Digital Infrastructure Service provider that built West Africa’s first Open-Access submarine cable system in 2010. In 2015, the company launched its data centre operations in West Africa with MDXi with a $40M investment resulting in West Africa’s largest Tier III data centre in Lagos, Nigeria, and now with presence in Accra and Abidjan.

In 2019, she chaired the Presidential Committee to develop Nigeria’s National Broadband

Plan for 2020 – 2025. MainOne was acquired by Equinix, the global digital infrastructure company as its entry

point to doing business in Africa on April 1, 2022.

Patrick Akinwuntan is a Chartered Accountant, Pan African Banker and Fintech expert. He holds an MBA from OAU IleIfe, is a Fellow of the Institute of Chartered Accountants of Nigeria and an alumnus of the Harvard Business School Senior Executive program. He is also an honorary Fellow of the Chartered Institute of Bankers of Nigeria and Associate of the Chartered Institute of Taxation of Nigeria.

Patrick commenced his professional career at EY International and practiced investment banking at Manufacturer’s Merchant Bank (now Fidelity Bank) before a 26-year pan-African banking career at Ecobank where he held various executive positions across Africa. He retired in 2022 as the Managing Director & Regional Executive of Ecobank Nigeria.

Patrick has an extraordinary passion for innovation, entrepreneurship, financial inclusion and innovation in financial services. He led the launch of the first international credit-card in West Africa, a unified pan-African banking App and instant fund transfers across 33 African countries in 18 currencies.

Patrick has extensive board-level experience which includes non-executive director positions at Africa Finance Corporation (AFC), FMDQ Securities Exchange, First Securities Discount House (FSDH) and premier Chairman of Accion Microfinance Bank Limited. He currently serves on the Disciplinary Tribunal of the CIBN and was Chairman of the Ethics and Professionalism Committee of the Bankers Committee between 2018 and 2022. He is also an independent non-executive director on the board of MudoZangl Nigeria Limited and Opolo Global Innovation Limited.

Awarded best retail banker in Africa for 2016 by the Asian Banker, Patrick is co-Chair of the Advisory board of retail banking Councils for Africa and a member of the Board of Trustees of the Fintech Association of Nigeria.

He is currently an Adjunct Faculty at the Lagos Business School where he is Academic Director of the Global CFO program and the Global CEO Africa program.

At a private level, Patrick is a chorister and choir ambassador of the Musical Society of St. Agnes Catholic Church Maryland, Lagos.

is the Senior Vice Chairman, Africa, Standard Chartered Bank. Prior to this role, she was Managing Director and Chief Executive Officer of Standard Chartered Bank Limited, Nigeria. Prior to joining the bank in March 2011, she was an Executive Director at First Bank of Nigeria Plc and prior to that Managing Director of Kakawa Discount House, Nigeria. She also worked in Citibank for 9 years in senior leadership roles in Nigeria and Tanzania.

Called to the Nigerian Bar in 1985, Bola Adesola has over 26 years banking experience. An alumnus of Harvard Business School and Lagos Business School, she also holds a Law degree from the University of Buckingham, UK.

Bola is passionate about the development and economic empowerment of women and in 2001 cofounded Women in Management, Business and Public Sector (WIMBIZ), Nigeria’s fore-most women-oriented network. She is an Honorary Fellow of the Chartered Institute of Bankers Nigeria and sits on the boards of the Financial Markets Dealers Quotations Plc and Nigeria Inter-bank Settlement Systems Plc. Bola also chairs the Central Bank of Nigeria Bankers’ Sub-Committee on Economic Development, Sustainability and Gender and was recently appointed the first female President of Lagos Business School Alumni Association (LBSAA). She actively mentors and coaches young people and is passionate about reading and travelling. She is married and is the proud mother of twin girls.

Bola Adesola was appointed to the United Nations Global Compact Board by the UN Secretary General in June 2015.

is the Co-Founder of Trans Sahara Investment Corporation, a Private Equity Firm based in Lagos Nigeria. He was the MD/CEO of Central Securities Clearing System Plc, the Central Securities Depository of the Nigerian Capital markets. Prior to joining CSCS, Kyari was the MD/CEO at ValuCard Nigeria Plc (now Unified Payments Systems Limited). He transformed an organization that was erstwhile unprofitable into an efficient, resourceful, more cohesive and customer centric, institution that quickly became extremely profitable. He was instrumental in introducing Visa Cards to the Nigerian payments ecosystem. He was in FSB International Bank Plc (Fidelity Bank Plc), where he served as Executive Director, Electronic Banking, Information Technology and Operations.

Prior to his return to Nigeria in 2001, Kyari worked at Hewlett-Packard Company in Silicon Valley, Kyari was a member of the Senior Management Team leading a part of $5 billion business unit. He was responsible for creating and implementing IT initiatives as well as managing marketing programs, some of which saved the company $85 million dollars in annual costs. His role in HP cut across various functions.

Kyari is the former Chairman of the Nigerian Economic Summit Group (NESG). He is Chairman of SUNU Assurance Plc, Chairman Ventures Platform, Chairman ARCA Payments Ltd, Director CRC Credit Bureau and an independent Non-executive Director of Standard Chartered Nigeria Ltd.

Kyari holds an M.S. in Nuclear Engineering from Oregon State University and a B.Sc. in Physics from the Ahmadu Bello University. He is an avid reader and enjoys mentoring and coaching aspiring professionals. Kyari is married with children.

Dr. Tunde Lemo is the Chairman of Titan Bank and Flutterrwave amongst many other boards that he sits on.

Mr. Lemo started his career in Arthur Andersen & Co Chartered Accountants in 1985 and over the years, he held various other positions in Finance and Control as well as providing significant leadership and top management training both in the public and private sectors.

He was the Managing Director of Wema Bank plc prior to his appointment as the Deputy Governor in charge of Operations, Central Bank of Nigeria from 2003 to 2014; he was also Deputy Governor, Financial Systems Surveillance.

He is a Fellow of the institute of Chartered Accountant of Nigeria as well as a Fellow of the Chartered Institute of Bankers.

He was awarded with the prestigious National honour of the Officer of the Federal Republic (OFR) in November, 2011.

is a seasoned regulator at Securities and Exchange Commission (SEC) where she joined the commission in 1986 as an assistant financial analyst. Her career as a regulator has spanned many functions and departments in the Commission, from corporate finance, administration, to providing structural, policy and due diligence for capital market transactions.

She has also been responsible for managing several landmark capital market projects, including the registration of Capital Market Operators, articulating rules for bonds and equities; Mergers, acquisitions and Takeovers, and managing the banking and insurance industry consolidations between 2005-2007.

Uduk served as the pioneer Head of the Operations Division in the Lagos Zonal Office and has headed the following Departments in the Commission: Internal Control, Investment Management, Financial Standards and Corporate Governance and Securities, and Investment Services Department, among others.

is the pioneer Managing Director/Chief Executive Officer of EDFIN Microfinance Bank Limited. EDFIN prides itself as the first specialized Education Microfinance Bank with unique and well researched products and services tailored to cater for the needs of its customers and the Education Ecosystem. EDFIN Microfinance Bank under the eminent leadership of Bunmi Lawson officially commenced operations in April 2019 with its registered office at Surulere Lagos state and has projections to grow into a Nationally Microfinance Bank as well as the globally recognized bank of choice for education financial solutions in Africa. Its shareholders are Gray Matters Capital, an investment company based in the USA.

Ms. Lawson holds a Master’s degree in Business Administration from the IESE Business School, University of Navarra and is an alumnus of the Lagos Business School. She is a Fellow of the Institute of Chartered Accountants of Nigeria and a Member of the Chartered Institute of Bankers of Nigeria.

She is also a Fellow of the following Institutes; Institute of Credit Administration of Nigeria, Institute of Credit & Collections Management of Nigeria and Association of Investment Advisers & Portfolio Managers of Nigeria. She is also a Board of the following; Enhancing Financial Innovation & Access (EFInA), Trium Venture Capital Limited and an Independent Director CRC Credit Bureau Limited; She is an Advisory Board Member of Bridge International Academies, Nigeria; Vi

A lifetime of social and economic impact

I have had over 30years post graduate experience of which the last 20 years has been work that has had a social impact as the CEO. The year 2000 was very transformational for me as it made me dedicate my career to creating significant social impact.

Creating jobs and businesses for Nigerian youths

First I led FATE Foundation as ED from 2000 to 2005 from its second year of being established. In that time over 5,000 entrepreneurs were trained creating jobs for tens of thousands some of these businesses have become leaders in their areas of specialization. See the FATE Foundation at 20 video here. https://youtu.be/ubjBNJbXJQc

Creating access to financial services for low income households

After FATE Foundation I led Accion Microfinance bank as its pioneer CEO. Ms. Bunmi Lawson is the immediate past and the pioneer Managing Director/Chief Executive Officer of ACCION Microfinance Bank Limited. She led the commencement of operations of the bank in May 2007 starting with one branch and 18 staff and grew the bank to become a National Microfinance Bank with over 259,313 customer accounts and 37,800 active borrowers serviced in over 62 branches in 6 states in Nigeria and over 1,000 total staff members as at Dec 2017 when she completed her tenor in line with the Central Bank of Nigeria’s regulations. She oversaw the growth of the bank to become one of the top 5 microfinance banks in Nigeria with year on year consistent growth over the ten year period. Under

Bunmi’s leadership the bank achieved profitability within its first full 12 months and has consistently ranked number one. See a tribute to me done by Accion MfB after my 10 year tenor as the CEO https://youtu.be/_MkJcuF3XpM

Creating access to quality education in Nigeria

After Accion, I became very concerned about the quality of education and the access to education of low income households. Setting up EdFin Microfinance Bank the first specialized education finance Bank in Nigeria. The theory of change is that when education entrepreneurs get access to finance they can improve the quality of education as well as increasing access. Students with tuition loans can also access the education they require. Check out more information on EdFin at www.edfinmfb.com

Adding value as a Nigerian citizen

In my personal life I have also continued to focus on giving back and building Nigeria to be great. I am on a number of boards; Board of Bridge International Academies one of the largest school chains focused on providing education to low cost households. Pioneer VP of the Fintech Association of Nigeria ( now a member of the board of trustees) leading the drive to use technology to achieve financial inclusion. Pioneer VP of the Women in Finance Organization supporting gender issues within the financial sector. I am also on the board of EFInA a leading non-profit organization driving financial access and innovation in Nigeria. www.efina.org.ng. On the board of CRC credit bureau Limited using data to drive access to credit. Mentor in WimBIZ, LBS EDC and to numerous others. I am also an Angel a member of the Lagos Angel Network providing equity capital to support startups and develop Nigeria through the success of these businesses. I am on the board of Trium Venture capital firm a company founded by Mr. Aigboje Aig-Imoukhuede to fund startup ventures in the area of financial technology that makes social impact. I have led various speaking engagements including at the Lagos Business School, the World Economic Forum, the Harvard Business School, Oxford University.

is the founder and CEO of SystemSpecs, the indigenous software company most famous for the Remita e-payment solution which powers Nigeria’s Treasury Single Account policy.

Before Obaro started the company in 1992, he had built a decade-long successful career as a software developer and IT executive. He was among the team, at the now defunct International Merchant Bank (IMB), that built Nigeria’s first ever online banking platform.